The global economy is experiencing several turbulent challenges. Inflation higher than seen in decades, tightening financial conditions in most regions, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic all weigh heavily on the outlook.

Normalisation of monetary and fiscal policies that delivered unprecedented support during the pandemic is cooling demand as policymakers aim to lower inflation back to a target. But a growing number of economies are in growth slowdown or outright contraction. The global economy’s future health rests critically on the successful calibration of monetary policy, the course of the war in Ukraine and the possibility of further pandemic-related supply-side disruptions, for example, in China.

Recent reports by the International Monetary Fund and the World Bank project that the slowdown experienced in global economies in 2022 will continue through 2023.

According to the IMF’s October 2022 World Economic Outlook Update, global growth is projected to slow from 6% in 2021 to 3.2% in 2022 and 2.7% in 2023. This is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic and reflects significant slowdowns for the largest economies:

- A US GDP contraction in the first half of 2022

- A euro contraction in the second half of 2022

- Prolonged COVID-19 outbreaks and lockdowns in China with a growing property sector crisis

About a third of the world economy faces two consecutive quarters of negative growth. Global inflation was forecast to rise to 8.8% in 2022 and then decline to 6.5% in 2023. Upside inflation surprises have been more widespread among advanced economies, with greater variability in emerging markets and developing economies.

Risks to the outlook remain unusually large and to the downside. Monetary policy could miscalculate the correct stance to reduce inflation. Policy paths in the largest economies could continue to diverge, leading to further US dollar appreciation and cross-border tensions. More energy and food price shocks may cause inflation to persist for longer and global tightening in financial conditions could trigger widespread emerging market debt distress. Halting gas supplies by Russia could depress output in Europe. A resurgence of COVID-19 or a new global health scare might further stunt growth. A worsening of China’s property crisis could spill over to the domestic banking sector and weigh heavily on the country’s growth, with negative cross-border effects and geopolitical fragmentation may impede trade and capital flows, further hindering climate policy cooperation. The balance of risks is tilted firmly to the downside, with about a 25% chance of one-year-ahead global growth falling below 2%.

Warding off these risks starts with monetary policy staying the course to restore price stability. Front-loaded and aggressive monetary tightening is critical to avoid inflation de-anchoring as a result of households and businesses basing their wage and price expectations on their recent inflation experience. Fiscal policy priority is the protection of vulnerable groups through targeted near-term support to alleviate the burden of the cost of living crisis felt across the globe. But its overall stance should be to remain sufficiently tight to keep monetary policy on target.

The World Bank’s 2022 report entitled “Global Economic Prospects” reported that growth in LatAm and the Caribbean (LAC) rebounded to an estimated 6.7% in 2021, boosted by supportive external conditions, and, in the second half of the year, a rapid progress on COVID-19 vaccination and a sharp decline in new cases. Regional growth was projected to slow to 2.6% in 2022 and 2.7% in 2023, reflecting sluggish labour market improvement, tighter macroeconomic policy, softer external demand, and a fading boost from the recent increases in commodity prices. Growth in the forecast horizon will not be sufficiently robust to reverse the region’s longstanding decline in per capita income relative to advanced economies. Downside risks to the forecast include renewed surges in COVID-19 cases; financial stress; disruption due to natural disasters, including weather events linked to climate change; and, in the longer term, failure to implement productivity-enhancing and other needed reforms.

Economic conditions in LAC have continued to improve since mid 2021 as the pandemic eased and external conditions remained supportive. COVID-19 vaccination has progressed rapidly, whilst new cases and deaths have also declined rapidly. Strong growth in key export destinations (The United States and China), high commodity prices and continued strong remittance inflows to LatAm countries supported growth in 2022. In most cases, inflation has risen across the region, above central banks’ targets. The increase reflects firming demand associated with the economic reopening, coupled with rising global food and energy prices.

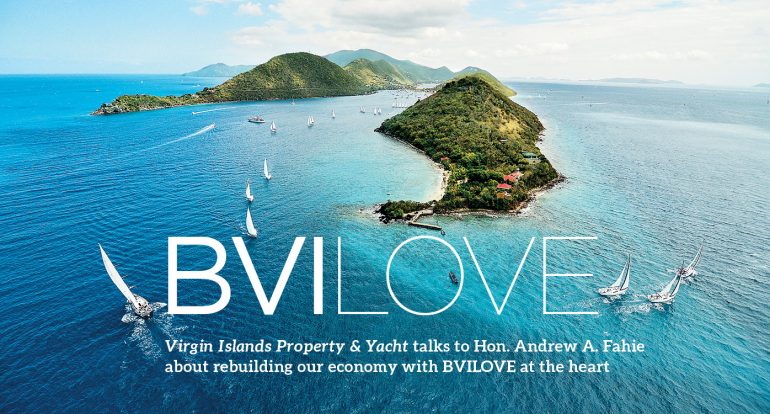

Looking specifically at the Caribbean, growth of 7.3% was projected for 2022 and 5.9% for 2023. This growth reflects a significant contribution from Guyana, where offshore oil production has been a major contributor and the return of tourism to those jurisdictions reopening their borders early, such as the Dominican Republic, where stay-over arrivals have already surpassed pre-pandemic levels. Growth should continue in the years ahead as the entire region reopens for stay-over tourism and the cruise industry returns to full capacity, taking advantage of the pent up demand from the historically strong North American feeder markets.

BCQS research shows an average increase in construction costs of 19.22% for the fourteen jurisdictions surveyed, for the two years that have elapsed since our last market study in 2020, with a range of +13.10% to +29.99%. The most significant increase occurred in Anguilla, reflecting the 13% Goods and Services Tax (GST) introduced in July 2022 and the amount of ongoing construction activity in that jurisdiction. The average increase of 19.22% clearly shows the unprecedented cost increases experienced since the onset of the COVID-19 pandemic in both material and shipping costs. Shipping costs have always been a significant contributor to construction costs in the Caribbean due to the number of imported materials. Whilst labour has increased slightly in a number of jurisdictions, most of the escalation has resulted from increases in imported material costs and shipping. Whilst we acknowledge that some material costs have reduced in the second half of 2022, we do not foresee costs reducing to pre-pandemic levels.

While generally remaining reasonably aggressive and competitive, profit margins have increased in three jurisdictions, remained static in ten jurisdictions, and decreased in one jurisdiction. Aruba reported a single digit margin of 7.5%, while Anguilla, the Bahamas and St. Lucia led the way with reported margins of 15%, 15% and 17.5%, respectively. The remaining ten jurisdictions reported margins of between 10 and 12%. The overall average profit margin for the fourteen jurisdictions surveyed is 11.36%.

In conclusion, whilst the Caribbean region continues to deal with the aftermath of the COVID-19 global pandemic, increasing interest rates and high inflation, the outlook is not all doom and gloom. Travel and tourism, the largest single contributor to GDP in the region, has rebounded strongly from the lows of 2020, with the three KPI’s, Occupancy, Average Daily Rate and Revenue per Available Room all posting unprecedented year-on-year growth in 2021 and 2022 and are close to surpassing the highs of 2019.

BVI Spotlight

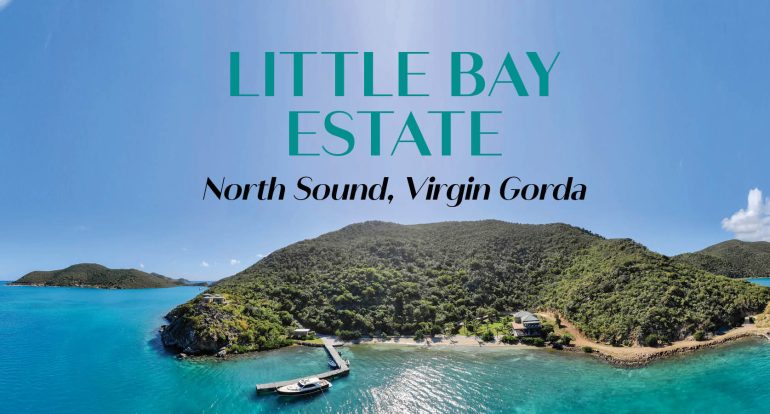

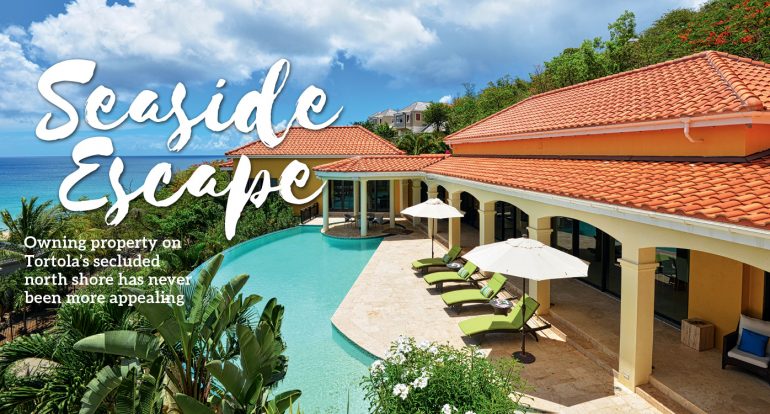

Turtle dove, fungi music, beautiful white sand beaches and boulders rising from the volcanic islands, are words synonymous with the BVI. It is home to over 31,000 people comprising of both locals, known as BVIslanders and expatriates who comprise the majority of the workforce. The British Virgin Islands is an archipelago located in the northeastern Caribbean, just 60 miles east of Puerto Rico. It is an overseas territory with its economy built on mainly the financial and tourism sectors.

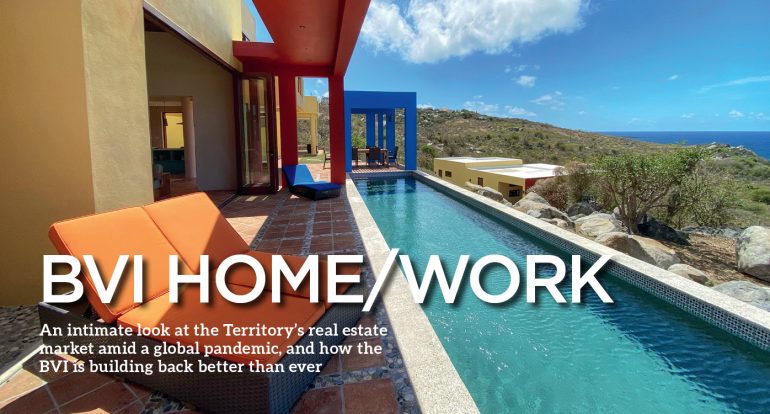

Belmond Cap Juluca, image Richard James Taylor

The territory has weathered many storms throughout the years, one of which was the passage of the 2017 hurricanes that cause catastrophic damages throughout the islands. Over the next two years, the territory was able to rebuild homes, commercial buildings and vacation properties, and commerce once again resumed. The sense of normalcy did not last as the year 2020 saw the emergence of the COVID-19 global pandemic that affected every corner of the earth. This caused the closure of borders in many countries and the BVI, though tucked away in the tropics, was not immune to this devastation.

Notwithstanding the adverse impact of the pandemic, the BVI real estate market showed signs of improvement from 2019 to 2022 as the volume of property sales steadily increased with BVIslanders being an average of 85% of the primary purchasers and an average of 62% of the monetary real estate transactions. Within 2019 to 2021 there was a decrease in the volume of purchases by expatriates, again, mainly attributed to the effects of the pandemic that saw the closure of many borders, travel restrictions and the general economic uncertainty. However, the increase in sales amongst the BVIslanders was driven by the government’s stamp duty waiver initiative from May 2020 to May 2021 then extended to December 2021.

Figures show that in 2022, there was a slight decrease in the volume of overall sales, more so with the investment of BVIslanders as volume in real estate sales fell to 75% of the overall sales compared to previous years where sales volume by locals were up to its highest at 90%. We also saw a decrease in this sector as real estate monetary transactions decreased by a half while monetary sale purchases doubled for expatriates. Up to 70% of the over US$145m of considerations for real estate were attributed to purchases by expatriates. The increase was greatly impacted by the reopening of the borders in 2021 and credited to the creativity of real estate agents and attorneys to create virtual platforms for site visits and facilitation of the transfer process during restrictive movements of all.

The BVI real estate market continually shows signs of improvement, and this is expected to continue in 2023. It is advisable that expatriates seek the advice of a local attorney when purchasing properties in the BVI as this will assist overseas purchasers with being acquainted with the regulations of land acquisition and the requirements of seeking approval for a Non-Belonger Landholding License. •

Sources: BCQS International Cost Database

The World Bank, International Monetary Fund (IMF)

BVI Land Registry Department Transfers and transmissions data 2019 to 2022