The basics

Most homeowners’ insurance policies will provide coverage for damage to your home and your contents caused by fire, lightning, smoke, earthquake, windstorm, flood, vandalism and malicious mischief, and theft.

Loss of Use or Loss of Rents Coverage typically covers living expenses over and above your normal living expenses if you cannot live in your home while repairs are being made or if you are denied access by government order. The coverage will also pay for the loss of your rental income whilst the property is being repaired.

This coverage is often an optional extra under your Homeowners Policy that you should discuss with your insurance agent when taking out your Homeowners insurance.

Your Homeowners insurance should also provide coverage for liability claims, medical payments to third parties, and legal costs if a lawsuit is brought against you. The most common amount of liability coverage included in a homeowners policy is $100,000, but you may need to purchase higher limits, depending on your circumstances.

What’s not covered?

It is important to read your homeowner’s insurance policy to find out exactly what is and is not covered. Do this before you suffer a loss, so you won’t be surprised and if you have any questions, talk to your insurance agent. Most insurers exclude damages caused by an act of war, nuclear accident and terrorism.

A diamond is forever. Or is it?

Most homeowners’ insurance policies will also limit coverage for certain high-priced or hard-to-replace items. Additional endorsements will be necessary to protect items like engagement rings, watches, furs, antiques, and other valuables. You’ll need to have each item appraised to ensure that they are properly protected.

How much coverage is enough?

Some homeowners simply purchase enough insurance to satisfy their mortgage lender whilst others confuse the real-estate value of their home with what it would cost to rebuild it. In reality, you should have enough insurance to rebuild your home in the event it is completely destroyed. Some steps to ensure you’re fully covered:

Review policy limits annually. Making sure your home has sufficient insurance coverage should be a periodic exercise; ideally homeowners should contact their insurance agent at least once a year. Other events that should trigger a call to your insurance agent are if you’ve made a major alteration or addition to your home, or purchased new furniture or equipment such as a plasma TV for Christmas.

A simple way homeowners can make sure they’re on the same page as their insurer about rebuilding costs is to work out the replacement cost of their own property. A rule of thumb is that standard homes should cost in the region of $150 per square foot to rebuild whilst more expensive homes can cost $250 or more per square foot. It’s a good idea to talk to a local contractor or architect to find out the latest rebuilding costs for the territory.

Know what is included and not included in your policy.

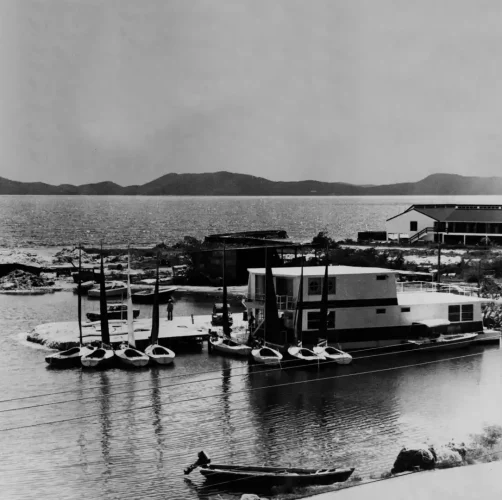

It’s up to homeowners to ensure that they cover all of the structures at their premises under the policy. Swimming pools, retaining walls or docks may need to be specifically noted to ensure correct coverage.

Most policies will provide replacement cost coverage for the premises, which will pay for the repair or replacement of damaged property with similar materials. However under-insuring your property could leave you with a significant shortfall in the event of a claim.

How deep are your pockets?

To save money, consider choosing a higher policy deductible. In the event of a loss you’ll be required to pay this amount out of your own pocket before your homeowners insurance takes over, but in the meantime, you’ll save some premium.

Sound the alarm

Don’t forget to tell your insurer if you have hurricane shutters, storm-resistant windows or a home security system. Most insurers offer discounts for such safety features.

Shop around

Most people will get quotes from several insurance companies when looking for homeowners insurance. But remember, the lowest price does not always equal the best deal. It is important to compare the coverage each policy offers and not simply get carried away with the price as most people do. You should also consider the insurance company's financial ratings and stability, its reputation in the market and your agent's customer service record. Of course you can do your own research online at www.ambest.com or www.standardandpoors.com.

Other Insurance Coverage to Consider

Auto insurance

If you think that there is no connection between buying a home and auto insurance, think again. If you’re ever in an auto accident that is the result of your negligence, all of your assets (including your home) could be subject to liability claims if the claims exceed the liability limits of your auto insurance policy. The basic limits of liability in the British Virgin Islands are $25,000 any one

person / $75,000 any one accident for Bodily Injury and $30,000 any one accident for Property Damage–not enough to protect your assets in the event of a major claim. Approximately 75 percent of insured drivers in the BVI carry the minimum limits of liability.

So, you should reevaluate the existing liability limits on your auto insurance policy to make sure that you have adequate coverage to protect your home. If you feel that you need even more coverage, you may want to look into purchasing a separate umbrella liability policy, which would pay for damages that exceed the coverage limits on your auto and/or homeowners insurance policy.

Umbrella insurance

Umbrella insurance is not just for the wealthy. With the common occurrence of lawsuits, umbrella insurance is becoming a vital part of every home, auto, and watercraft owner’s insurance protection. Umbrella insurance is designed to give one added liability protection above and beyond the limits on homeowners, auto, and watercraft personal insurance policies.

Disability insurance

Would you be able to make your monthly mortgage payments if you were unable to work due to an accident or illness? A disability insurance policy will pay you a monthly benefit to replace a portion of your income until you are able to work again. BVI Social Security does provide some coverage and also some employers may provide disability insurance for their employees. If your employer does not offer disability insurance or if you are self-employed, you can purchase an individual disability policy.

Life insurance

What if you were to die before your mortgage was paid off? Would your family be able to keep up with the remaining mortgage payments? Life insurance can provide your family with the funds to pay off their debts, as well as replace a portion of your income. While many employers offer some level of life insurance coverage to their employees, this amount of coverage may not be enough to provide financial security to your family. So, you may want to consult your insurance professional to help you assess your family’s life insurance needs.